Byrd Argument #1 – The National Firearms Act of 1934 Is a Transfer and Manufacturing Tax.

Back in 1934, both the House Ways and Means Committee and the Senate Finance Committee described H.R. 9741 as follows:https://www.gunowners.org/latest-news/#_edn1

- “Section 1… defines the firearms subject to the taxing provisions of the bill.”

- “Section 3(a) imposes a transfer tax of $200 per firearm on the transfer thereof in the continental United States. Such tax is to be in addition to import taxes and paid by the transferor and is to be evidenced by stamps affixed to the order for transfer.”

- “Section 4(a) makes it unlawful for any person to transfer a firearm except in pursuance of a written order from the transferee.”

Silencers and short-barreled firearms are not per se regulated under the National Firearms Act of 1934. Instead, the manufacture, import, and transfer is taxed and recorded. The only “crimes” that can be committed under the NFA are tax and record keeping crimes—by not affixing the required tax stamp to a transfer order prior to transfer. The NFA was not drafted in 1934 as a direct regulatory policy but rather as an excise tax. Today, JCT estimates the ten-year cost of eliminating the tax at $1.7 billion for suppressors and $295 million for short-barreled firearms—a clear budgetary impact.

Byrd Argument #2 – Congress Redrafted the National Firearms Act as a Tax to Avoid Direct Regulation.

Back in 1934, Congress’ claimed authority to regulate NFA “firearms” was via a taxation regime. One Congressman explained the constitutionality of the legislation as follows: “I think that under the Constitution the United States has no jurisdiction to legislate in a police sense with respect to firearms… I think that the only possible way in which the United States can legislate is through its taxing power, which is an indirect method of approach, through its control over interstate commerce…’ In 1934, Congress clearly designed and intended the NFA as an exercise of its power to tax rather than an exercise of a direct regulatory power or a federal police power.

Byrd Argument #3 – The Supreme Court Held That the National Firearms Act Is Primarily an Excise Tax in 1937.

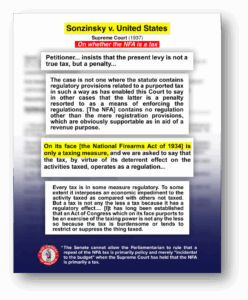

Sonzinsky v. U.S. (1937) affirmed what Congress intended, that the NFA is a tax. The Supreme Court held that the NFA did not cease to be a tax simply because it has secondary policy implications. The Supreme Court went on to affirm Sonzinsky in NFIB v. Sebelius (2012).[ii] Also, every subsequent federal court has also agreed that the NFA is primarily an exercise of Congress’ power to tax and that’s why it’s not unconstitutional under the Second Amendment.

- “[T]he statute is a valid exercise of the taxing power… [T]he fact that it incidentally accomplishes goals other than raising revenue does not undermine its constitutionality.”[iii]

- “[The NFA] is constitutional because it is ‘part of the web of regulation aiding enforcement of the transfer tax provision.’”[iv]

- “[O]n its face, the NFA is a taxing scheme. The statute collects occupational and excise taxes from businesses and transactions involving listed firearms—which include short-barreled rifles [and] silencers.”[v]

Byrd Argument #4 – Amending the Tax Code and Repealing Excise Taxes is Routine on Budget Reconciliation.

Sections which strike and insert language in the tax code may be regularly found in budget reconciliation bills.[vi] Furthermore, the One Big Beautiful Bill Act includes many amendments to federal excise taxes.[vii] And prior reconciliation bills such as the Inflation Reduction Act have also amended excise taxes too.[viii]

Byrd Argument #5 – Eliminating the Excise Tax Does Not Completely Deregulate Suppressors.

Even if silencers are removed from the NFA and no longer subject to registration and fingerprinting, the language does not completely deregulate silencers. Silencers will remain regulated as firearms under the Gun Control Act of 1968 and subject to different but similar paperwork, including background checks on commercial transfers and registration Forms 4473 for gun tracing purposes.

Byrd Argument #6 – NFA Requirements Like Fingerprinting and Registration Paperwork Are Part of the Tax.

During a Ways and Means Committee hearing on the NFA in 1934, one Representative asked, “s it not the taxation power which provides the basis for requiring the registration of the firearms now owned and possessed?” Another Congressman replied, “Yes. In executing or administering the taxation provision it is important to be able to identify arms to see which possessors have paid taxes and which firearms have been taxed and which have not.” Courts have also held this to be the case, stating that “[the NFA requires] payment of a transfer tax and registration as an aid in collection of that tax…”[ix] Consequently, “[t]he NFA’s ‘taxation and registration’ requirements… have been upheld as a valid exercise of legislative taxing authority.”[x]

The NFA is primarily a tax. The Senate must not take “no” for an answer from the Parliamentarian. A vote to overrule the Senate Parliamentarian would certainly be justified given this overwhelming evidence.

https://www.gunowners.org/latest-news/#_ednref1 73rd Congress. 2nd Session. H. Rept. 1780 and S. Rept. 1444 to accompany H.R. 9741.

[ii] “None of this is to say that the payment is not intended to affect individual conduct. Although the payment will raise considerable revenue, it is plainly designed to expand health insurance coverage.

But taxes that seek to influence conduct are nothing new. Some of our earliest federal taxes sought to deter the purchase of imported manufactured goods in order to foster the growth of domestic industry. Today, federal and state taxes can compose more than half the retail price of cigarettes, not just to raise more money, but to encourage people to quit smoking. And we have upheld such obviously regulatory measures as taxes on selling marijuana and sawed-off shotguns. See Sonzinsky v. United States, 300 U.S. 506, 513 (1937).

Indeed, “[e]very tax is in some measure regula-tory. To some extent it interposes an economic impediment to the activity taxed as compared with others not taxed.” Sonzinsky, supra, at 513. That §5000A seeks to shape decisions about whether to buy health insurance does not mean that it cannot be a valid exercise of the taxing power.”

[iii] United States v. Gresham, 118 F.3d 258, 262 (5th Cir. 1997).

[iv] United States v. Gresham, 118 F.3d 258, 262 (5th Cir. 1997).

[v] United States v. Cox, 906 F.3d 1170, 1179 (10th Cir. 2018).

[vi] https://www.congress.gov/amendment/117th-congress/senate-amendment/5472/text

[vii] EXAMPLES:

- 111106. Repeal of excise tax on indoor tanning services.

- 112021. Modification of excise tax on investment income of certain private colleges and universities.

- 112105. Excise tax on remittance transfers.

(as reported to the House Rules Committee)

[viii] EXAMPLES:

- 10201. Excise Tax on Repurchase of Corporate Stock.

- 11003. Excise Tax Imposed on Drug Manufacturers During Noncompliance Periods.

- 13101. Deficiency procedures not to apply [to] certain excise taxes.

- 13201. Coordination With Credit Against Excise Tax.

- 13204. Termination of Excise Tax Credit for Hydrogen.

[ix] United States v. Lim, 444 F.3d 910, 913 (7th Cir. 2006).

[x] United States v. Rush, 130 F.4th 633 (7th Cir. 2025).

Continue reading...