GOA Urges Senate to Finish the Job for Short Barreled Firearms

Last night, the House Rules Committee amended H.R. 1, the One Big Beautiful Bill Act, to include Sec. 2 of the Constitutional Hearing Protection Act—fully removing suppressors from the National Firearms Act of 1934.

GOA fully supports Sec. 112029 of the One Big Beautiful Bill Act. Elimination of the NFA’s unconstitutional excise tax & registration of suppressors is a massive victory for the 2nd Amendment. Suppressors will now be treated, de facto, as firearms subject to a NICS background check at point of sale.

But now, GOA is calling on the Senate to also protect short-barreled firearms and reduce the entire NFA tax to $0!

Passing the tax repeal language in the SHORT Act would prevent the weaponization of the National Firearms Act against gun owners. When the Biden administration attempted to ban 40 million pistols equipped with stabilizing braces, they used the 1934 NFA’s barrel length restrictions as justification for charging millions of Americans with felonies despite the fact that these accessories were approved by the ATF for over a decade.

Even Don. Jr. was forced to register his short-barreled firearms to avoid being raided by the Biden ATF! President Trump ran on protecting gun owners from the Biden’s ban on short-barreled firearms. Now, the Senate must help deliver on this campaign promise to gun owners.

Listen to President Trump’s campaign promise to protect pistol braced weapons and watch Don Jr. unwillingly register his short-barreled firearms on a livestream on this episode of the Minute Man Moment.

Repealing NFA Taxes Is Byrd Compliant

Following the House’s passage of the One Big Beautiful Bill Act on May 22nd, the Senate has a historic opportunity to end nearly 100 years of unconstitutional gun control of common use items such as suppressors and short-barreled firearms during the upcoming budget reconciliation process. The Constitutional Hearing Protection Act and Stop Harassing Owners of Rifles Today Act are written with Byrd compliant language to deliver this victory.

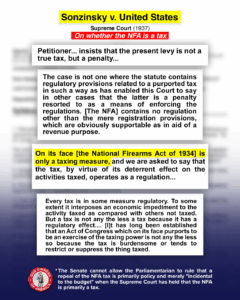

The language is Byrd compliant because first and foremost, the National Firearms Act’s primary function is as a tax. The Supreme Court in Sonzinsky v. US (1937) explicitly ruled that the NFA didn’t cease to be a tax simply because it has secondary policy implications.

To rule that the tax repeal language from the HPA and SHORT Act violate the Byrd Rule, the Senate Parliamentarian—who is a nonpartisan bureaucrat—would have to partisanly hold that the Supreme Court is wrong and that the NFA is primarily a regulation and incidentally a tax.

Also, every subsequent federal court has also agreed that the NFA is primarily an exercise of Congress’ power to tax and that’s why it’s not unconstitutional under the Second Amendment.

- “Insofar as the statute is a valid exercise of the taxing power, the fact that it incidentally accomplishes goals other than raising revenue does not undermine its constitutionality.”i

- “… it is well-settled that § 5861(d) is constitutional because it is “part of the web of regulation aiding enforcement of the transfer tax provision in § 5811.”ii

- “And on its face, the NFA is a taxing scheme. The statute collects occupational and excise taxes from businesses and transactions involving listed firearms—which include short-barreled rifles, silencers, and destructive devices.”iii

- “Having required payment of a transfer tax and registration as an aid in collection of that tax, Congress under the taxing power may reasonably impose a penalty on possession of an unregistered firearm.”iv

- “Rush recognizes that §5861(d) mandates compliance with the NFA’s ‘taxation and registration’ requirements—requirements that have been upheld as a valid exercise of legislative taxing authority.”v

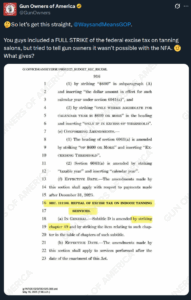

Removing these unconstitutional NFA restrictions through the reconciliation process is possible as it is primarily a change to the tax code. Such changes which strike and insert in the tax code are regularly found to be Byrd compliant (Example Thune Amendment). Additionally, House Republicans proposed to strike an excise tax on tanning salon beds, and no one raised Byrd concerns with that.

In fact, the One Big Beautiful Bill Act includes a number of amendments to federal excise taxes (as reported to the Rules Committee):

- 111106. Repeal of excise tax on indoor tanning services.

- 112021. Modification of excise tax on investment income of certain private colleges and universities.

- 112105. Excise tax on remittance transfers.

And prior reconciliation bills such as the Inflation Reduction Act have also amended excise taxes too:

- 10201. Excise Tax On Repurchase of Corporate Stock.

- 11003. Excise Tax Imposed on Drug Manufacturers During Noncompliance Periods.

- 13101. Deficiency procedures not to apply [to] certain excise taxes.

- 13201. Coordination With Credit Against Excise Tax.

- 13204. Termination of Excise Tax Credit for Hydrogen.

Congress’ claimed authority to regulate NFA “firearms” has always been a taxation regime. Without the tax, there is no mechanism to impose restrictions on the possession of these firearms. As part of the reconciliation process, it should therefore be possible to remove the $200 tax stamp and use conforming amendments to remove all documents related to the collection of this tax—like the registration forms.

Sec. 112029 of the One Big Beautiful Bill Act and GOA’s proposed short-barrel protections are Byrd compliant. But in any case, the Supreme Court has already ruled that the NFA is primarily a tax, so the Senate must not take “no” for an answer.

Win for Gun Owners Now Will Do Wonders in the Midterms

The Budget Reconciliation process presents a historic opportunity for Congress to remove archaic and arbitrary National Firearms Act (NFA) restrictions that have long infringed on the constitutional rights of Americans. Including the Constitutional Hearing Protection Act and the Stop Harassing Owners of Rifles Today Act into a bill which can pass with a simple majority would deliver an amazing victory for this administration and gun owners.

These unconstitutional regulations on suppressors and braced firearms have long been a priority for pro-gun voters to be removed. Delivering these policies would be a massive victory for the administration and Congress—showing commitment to the right to keep and bear arms.

According to the most recent polling of GOA members, over 90% of the 16,000+ respondents considered both the HPA and SHORT Act to be priority items to pass this Congress. This would raise morale and favorability before the midterm elections among gun owners, who, as President Trump consistently pointed out on the campaign trail, often do not vote.

Please reach out with any questions or if you would like to help GOA secure this incredible victory for gun owners.

In Liberty,

Aidan Johnston

Director of Federal Affairs

(314) 919-6118

United States v. Gresham, 118 F.3d 258, 262 (5th Cir. 1997).

[ii] United States v. Gresham, 118 F.3d 258, 262 (5th Cir. 1997).

[iii] United States v. Cox, 906 F.3d 1170, 1179 (10th Cir. 2018).

[iv] United States v. Lim, 444 F.3d 910, 913 (7th Cir. 2006).

[v] United States v. Rush, 130 F.4th 633 (7th Cir. 2025).

Continue reading...